📦 Fast Delivery – Order Now!

💸 Shop Safely – 100% Money-Back Guarantee

👨🔧 Lifetime Customer Support

Florida is called the Sunshine State for a reason. The sun shines almost all year. And because of that, solar panels are a great investment. But many people still ask: Are there any solar incentives in Florida? The answer is yes. There are several. And while the state itself offers fewer programs than others, you can still save money. Let’s take a closer look.

The main solar power incentive in Florida is the federal tax credit. This one is huge. It allows you to deduct 30% of the total cost of your solar system from your federal taxes. It includes the panels, inverter, and even the installation. And you can use it whether you’re installing at home or for your business.

This tax incentive for solar panels in Florida is available until 2032. After that, the rate drops. So, it pays to act now. Because every year you wait, your savings shrink.

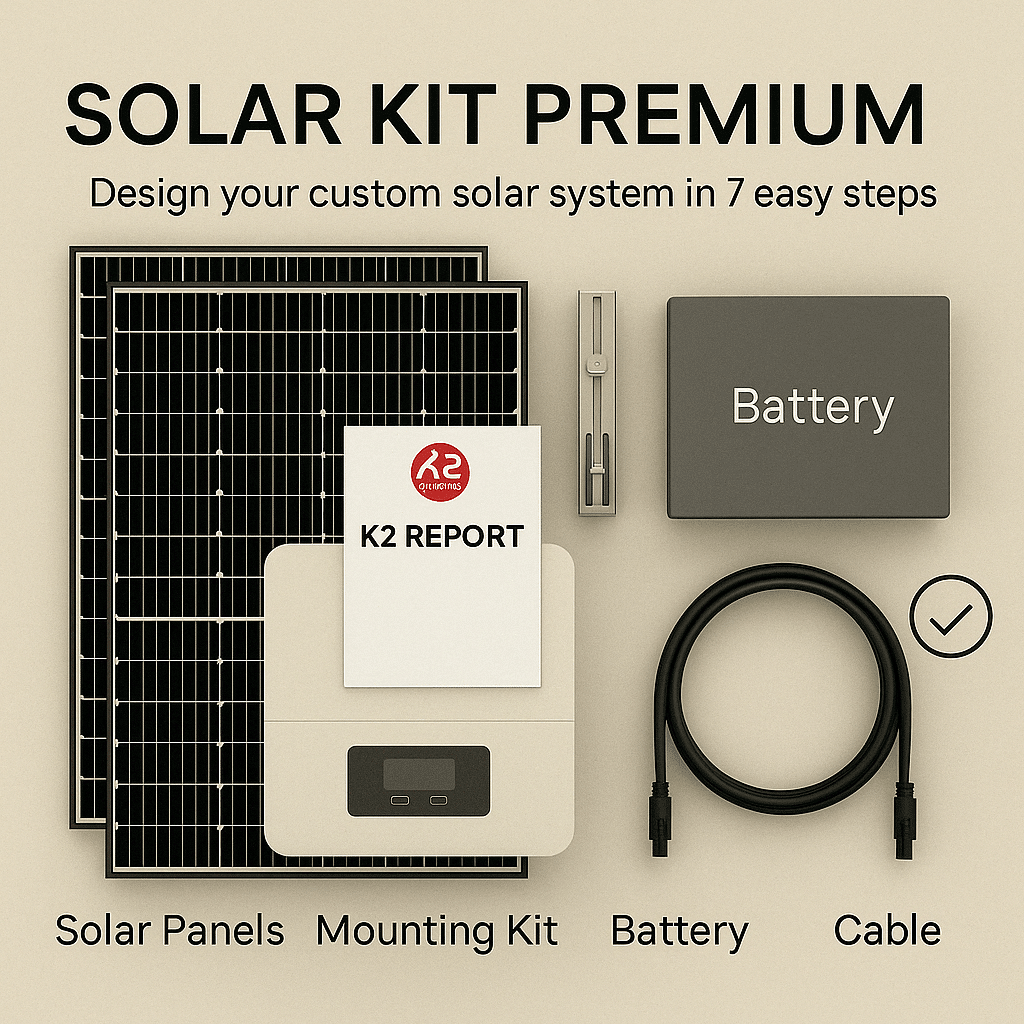

🔆 Premium Solar Kit – Your Custom Solar System in 7 Guided Steps

Design your solar setup with full flexibility and professional support: choose solar panels, inverter, battery, custom mounting kit, wiring essentials, combiner, and accessories – all step by step and fully compatible.

✅ Includes custom K2 mounting kit with professional layout planning

✅ Personalized K2 Report for your roof and module configuration

✅ DIY-friendly & pre-checked for compatibility

✅ 🎁 Battery discount included when bundled

Florida offers a property tax exemption. It sounds small. But it makes a big difference. When you install solar, your home’s value goes up. Normally, this would mean higher property taxes. But not in Florida. Here, the added value of the solar system is exempt from property taxes. That’s a long-term saving.

Another big plus: Florida waives the sales tax on solar equipment. That means you pay 0% sales tax on your solar panels, batteries, inverters, and more. This saves you 6% right away—a nice discount without any paperwork.

With net metering, you feed excess electricity back into the grid. And your utility gives you credits in return. In Florida, many utility companies still offer this program. However, policies may change. So, it’s best to install your system sooner rather than later.

Because the sooner you install, the sooner you lock in the benefits. And because net metering helps you save month after month, it adds up fast.

Here’s a clear breakdown of the most important incentives for solar panels in Florida:

🌞 Overview: Solar Incentives in Florida

| 📌 Incentive | 🏷️ Type | 💰 Benefit | 🕒 Validity |

|---|---|---|---|

| Federal Tax Credit (ITC) | Federal | 30% credit on total system cost | Until 2032, then reduced |

| Property Tax Exemption | State | No increase in property tax | Ongoing |

| Sales Tax Exemption | State | 6% savings on all solar equipment | Ongoing |

| Net Metering | Utility-based | Credit for excess electricity sent to grid | Depends on provider |

This table gives you a quick and easy summary of all solar panel incentives in Florida, including the most important tax incentives for solar panels in Florida and net metering options. Whether you’re interested in solar power incentives in Florida for your home or business, these benefits can save you thousands over time.

If you need help planning your solar project, calculating your savings, or claiming your incentives – AceFlex.us is here to support you. 💬 Reach out today for expert advice and a free consultation.

Some cities or counties offer extra solar panel incentives in Florida. These are limited, though. And they often depend on your utility provider. So, it’s worth checking with your local office or utility. Because while the state doesn’t offer rebates, some local programs do.

Solar system prices are stable. But incentives change. Because policies shift. And utility rules do too. So, waiting could cost you money. And since the federal tax credit starts shrinking in a few years, the clock is ticking.

At AceFlex.us, we help homeowners and businesses in Florida go solar—smart and affordable. We guide you through every step. From selecting the right panels to applying for tax incentives for solar panels in Florida, we take care of it all. And because we value transparency, you get real savings—no surprises.

👉 Contact us today and get your free solar quote. Let’s turn sunshine into savings—together.

You may not find as many state-level programs as in other places. But the combination of federal tax incentives, property tax exemptions, no sales tax, and net metering makes solar worth it. Add rising electricity prices, and the decision becomes even easier.

Yes, Florida offers multiple incentives, and they can significantly reduce your costs. You benefit from federal tax credits, property tax exemptions, and sales tax savings.

No, the panels are not completely free, but incentives and financing make them very affordable. Some companies offer $0-down options, yet you still pay over time.

It typically costs between $15,000 and $25,000, depending on energy use and system size. But with tax incentives and net metering, you recover a big part of that investment.

Absolutely yes, because Florida has high sun exposure and solid incentives. You lower your power bills every month, and the system increases your home’s value.

Usually, it takes 7 to 10 years, and that depends on usage and available incentives. But since electricity prices rise, savings grow faster over time.

The upfront cost can be high, and installation depends on roof condition. However, incentives help a lot, and long-term savings often outweigh the negatives.

Yes, some policies may need updates, and coverage could change slightly. But many insurers support solar, and the premium difference is often minimal.

It’s weather-dependent, and storage systems can be expensive. But with Florida’s sun and grid connection, downtime rarely becomes a major issue.

Not really, because buyers often like the energy savings and green benefits. But you must explain the system details clearly, especially if there’s a lease involved.

It covers 30% of the total system cost, and that includes labor and equipment. You claim it through your federal income tax return.

Yes, because Florida excludes added solar value from your property taxes. So you save money and still increase your home’s worth.

Yes, you don’t pay the 6% state sales tax on solar equipment. That saves you hundreds of dollars upfront.

Some do, but it depends on your provider and location. Check with your utility to see if rebates or extra credits apply.

Yes, most major utilities in Florida offer net metering. It lets you earn credits for extra power you send to the grid.

Not always, but you can still use the federal tax credit for solar batteries. It applies as long as the battery connects to your solar system.

Yes, commercial systems qualify for the same federal credit and tax exemptions. And with larger systems, the savings scale even faster.

AceFlex is one of the leading online retailers of renewable energy products and offers a wide range of solar products. We work with well-known manufacturers and wholesalers and can offer you cost-effective products in the field of photovoltaics so that you too can contribute to the energy transition.

Looking for an experienced team for planning your photovoltaic system without the hassle of doing it yourself? We are your trusted partner, offering comprehensive nationwide solutions. We provide expert consultation and supply of both photovoltaic systems and storage units tailored to your specific needs.

© 2025 Aceflex All Rights Reserved. Design by Media Pantheon, Inc.