📦 Fast Delivery – Order Now!

💸 Shop Safely – 100% Money-Back Guarantee

👨🔧 Lifetime Customer Support

📦 Fast Delivery – Order Now!

💸 Shop Safely – 100% Money-Back Guarantee

👨🔧 Lifetime Customer Support

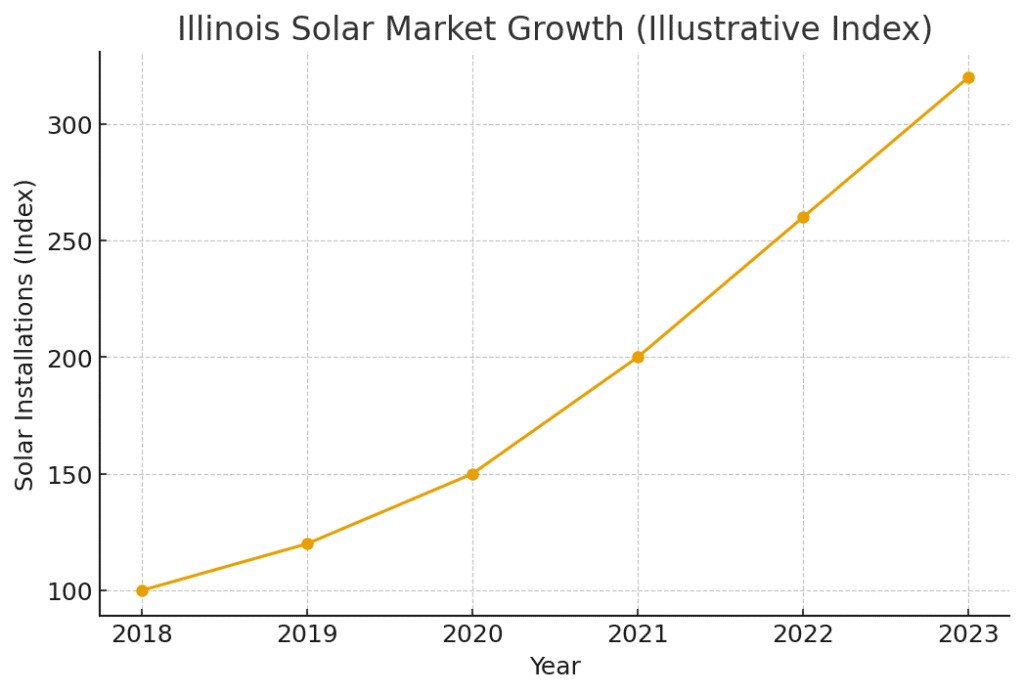

Illinois has quickly become one of the most attractive states for residential solar adoption. Rising electricity prices, supportive state policies, and a well-structured incentive ecosystem have positioned solar power in Illinois as a compelling long-term investment for homeowners. With programs designed to lower upfront costs and enhance affordability, Illinois continues to lead the Midwest in clean energy growth.

For homeowners evaluating the transition to solar, the combination of federal tax benefits, state-backed incentives, and a favorable net metering environment creates a powerful value proposition. This article breaks down the most important components so you can understand how solar fits into your home’s energy strategy.

Illinois has built a strong policy foundation that encourages both residential and commercial solar installations. The state’s Climate and Equitable Jobs Act (CEJA) and the Future Energy Jobs Act (FEJA) paved the way for substantial investment in renewable energy, and as a result, adoption has accelerated across the state.

Compared to many Midwestern states, Illinois offers one of the most balanced environments for solar—combining favorable policy, accessible incentives, and a maturing installer and equipment ecosystem. This makes solar power in Illinois a strategic decision not only from a sustainability perspective but also from a long-term financial standpoint.

Illinois stands out nationally for its strong state-backed incentives, which significantly reduce upfront solar costs. The two most influential programs are Illinois Shines (Adjustable Block Program – ABP) and Illinois Solar for All (ILSFA). Both programs reward homeowners for the clean energy their systems produce, creating a predictable and attractive revenue stream.

Illinois Shines (ABP)

Illinois Shines pays homeowners through Solar Renewable Energy Credits (SRECs). These payments are typically delivered upfront or over a structured schedule, directly lowering system ownership costs. The exact value depends on system size, location, and program block availability.

Illinois Solar for All (ILSFA)

Designed for income-eligible households, ILSFA provides substantial financial support to ensure affordability and equitable access to solar energy. Qualifying homeowners can receive dramatically reduced system pricing or participate in community solar with guaranteed savings.

Net metering plays a central role in the financial performance of solar systems across Illinois. Under current law, utilities such as ComEd and Ameren are required to provide full retail credit for excess solar energy sent back to the grid. This ensures homeowners receive dollar-for-dollar value for the electricity their system produces.

While rural co-ops and municipal utilities follow their own policies, most homeowners in the state benefit from structured net metering frameworks that maximize the economic value of solar.

Illinois will eventually transition to a “net billing” framework once utilities hit certain capacity caps, but current net metering remains highly favorable. For homeowners installing today, this means strong, predictable savings driven by both on-site consumption and grid credits—further strengthening the case for solar power in Illinois.

Illinois provides significant protection for homeowners through its Special Assessment for Solar Energy Systems. Instead of increasing your property taxes when you install solar, Illinois allows systems to be assessed as if they were conventional, non-solar equipment. In practice, this means your home value can rise due to solar, but your taxable assessment does not.

This incentive offers long-term financial stability and protects homeowners from unexpected cost increases. As a result, solar becomes not only an operational energy cost strategy but also a sound real-estate investment play—further reinforcing the long-term value of solar power in Illinois.

The cost of going solar in Illinois is highly competitive compared to national averages. Most residential systems fall in the $2.50–$3.40 per watt range before incentives, depending on equipment selection, roof complexity, and installer pricing. For a typical 6–10 kW system, total pre-incentive costs often land between $15,000 and $30,000.

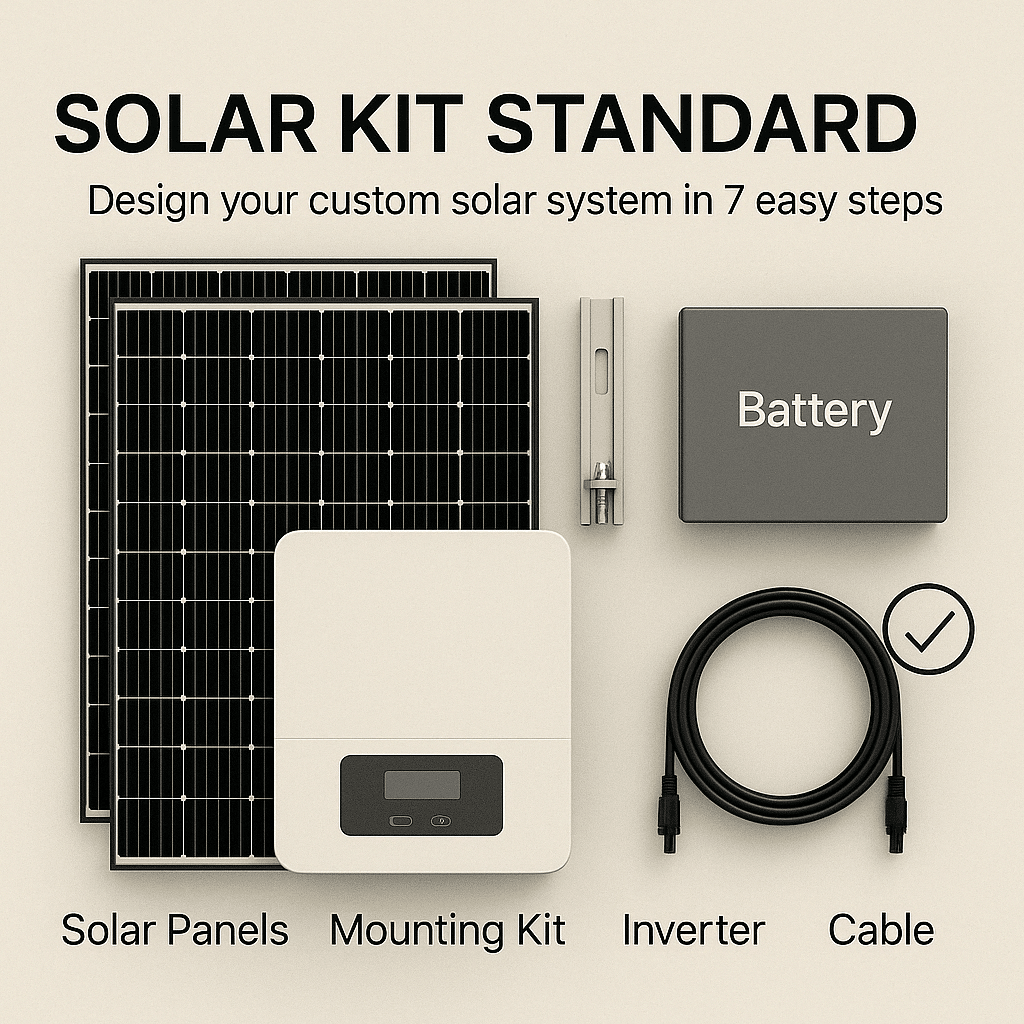

🔆 Standard Solar Kit – Your Custom Solar System in 7 Guided Steps

Design your solar setup with full flexibility and pre-configured mounting: choose solar panels, inverter, battery, mounting kit, wiring essentials, combiner, and accessories – all step by step and fully compatible.

✅ Includes mounting material from K2 Systems for standard layouts

✅ Choose only the components you need

✅ DIY-friendly and pre-checked for compatibility

✅ 🎁 Battery discount included when bundled

Illinois offers one of the strongest residential ROI profiles in the Midwest. With the combination of SREC payments, federal incentives, and full retail net metering, many homeowners experience payback times in the 6–10 year range, depending on system size and energy consumption.

Over a system’s 25-year lifespan, homeowners can expect tens of thousands of dollars in cumulative savings, driven by reduced utility bills, stable incentive revenue, and rising electricity prices.

Because Illinois has a mature incentive structure and predictable utility frameworks, long-term ROI remains stable—even as program blocks adjust over time. This financial consistency makes solar power in Illinois a compelling choice for both immediate savings and long-term energy planning.

Battery storage is becoming increasingly popular among Illinois homeowners seeking energy resilience and protection against outages.

Homeowners typically add batteries to improve:

In an environment where weather-related outages are increasing, pairing storage with solar power in Illinois offers long-term security and strengthens the overall value proposition of a residential solar system.

A structured approach helps homeowners navigate incentives, installation requirements, and utility processes efficiently. Here’s a streamlined workflow to get started with solar power in Illinois:

A clear process ensures homeowners capture every available incentive and maintain full eligibility from start to finish.

Even in a supportive state like Illinois, homeowners can miss out on savings due to avoidable errors. Key pitfalls include:

By identifying these risks early, homeowners can optimize performance and preserve the full financial benefit of solar power in Illinois.

Yes. Thanks to strong state incentives, full retail net metering, and stable electricity rates, solar offers one of the best ROI profiles in the Midwest.

Illinois is considered one of the top incentive states due to Illinois Shines (ABP), Illinois Solar for All, and the availability of SRECs that help lower upfront costs.

SRECs represent the renewable energy your system produces. In Illinois, many homeowners receive upfront SREC payments through the Illinois Shines program, which reduces project costs.

Costs vary by system size, but most Chicago-area systems fall between $2.60–$3.40 per watt before incentives. City-specific permitting and labor can influence final pricing.

Yes. Solar typically raises home value, and Illinois’ special assessment rule protects homeowners from increased property taxes due to the system.

AceFlex is one of the leading online retailers of renewable energy products and offers a wide range of solar products. We work with well-known manufacturers and wholesalers and can offer you cost-effective products in the field of photovoltaics so that you too can contribute to the energy transition.

Looking for an experienced team for planning your photovoltaic system without the hassle of doing it yourself? We are your trusted partner, offering comprehensive nationwide solutions. We provide expert consultation and supply of both photovoltaic systems and storage units tailored to your specific needs.

© 2026 Aceflex All Rights Reserved. Design by Media Pantheon, Inc.