📦 Fast Delivery – Order Now!

💸 Shop Safely – 100% Money-Back Guarantee

👨🔧 Lifetime Customer Support

📦 Fast Delivery – Order Now!

💸 Shop Safely – 100% Money-Back Guarantee

👨🔧 Lifetime Customer Support

Texas is one of the fastest-growing solar markets in the United States. Rising electricity rates, strong solar irradiance, and a clear shift toward home energy independence create a highly attractive environment for residential solar. For homeowners evaluating their investment case, understanding the most relevant solar incentives texas offers is a critical success factor.

While Texas does not provide a statewide solar tax credit, the combination of robust federal incentives, high-value local utility programs, and structural advantages like the property tax exemption significantly improves system economics. Together, these mechanisms accelerate ROI, reduce upfront costs, and make solar a compelling long-term strategy for energy-conscious homeowners.

The Federal Investment Tax Credit remains the single most influential financial incentive for solar in Texas. It provides a 30% tax credit on the total project cost — including solar panels, inverters, racking, batteries, and installation labor. This direct reduction delivers an immediate financial benefit and shortens payback periods across all system sizes.

You can learn more about the detailed mechanics of the ITC in our dedicated article on the topic: “Solar Energy & Federal Tax Credits”.

Because the ITC stacks seamlessly with local utility rebates, homeowners can unlock a powerful double-effect: lower upfront expenses and improved lifetime savings. For most Texans, the ITC is the primary driver that makes residential solar—whether professionally installed or DIY—a financially competitive upgrade.

This post references the former 30% Federal Solar Tax Credit. For current rules and guidance on solar after the federal tax credit , please read our updated overview.

Unlike other states, Texas does not offer a statewide solar tax credit. This often raises questions about whether the state is less favorable for residential solar. In practice, that isn’t the case.

Texas operates on a decentralized incentive structure. Instead of statewide subsidies, local utilities, cities, and municipal energy providers deliver targeted rebate programs with high practical impact. Combined with federally backed incentives and Texas’ generous renewable energy property tax exemption, the state remains strongly positioned for solar adoption.

For homeowners, this means the most valuable solar incentives texas provides are sourced at the federal and utility level—not the state level—while still offering highly competitive financial outcomes.

One of the most impactful solar incentives texas provides is the Renewable Energy Property Tax Exemption. When homeowners install a solar energy system, the added value normally increases the property’s assessed value. In Texas, this increase is 100% exempt from property taxes.

This incentive delivers long-term financial value because it protects homeowners from higher annual tax expenses while still allowing their property value to rise. Especially in fast-growing regions like Austin, Dallas–Fort Worth, and San Antonio, this exemption plays a major strategic role in improving overall system ROI and supporting long-term asset appreciation.

Although Texas has no statewide rebate program, many cities and utilities offer powerful local incentives that significantly reduce upfront costs. These programs are often limited-capacity and time-sensitive, which makes early application critical.

Key examples include:

Combined with the federal ITC, these local utility rebates create a strong financial foundation for residential solar projects. For many homeowners, these programs are the deciding factor in whether they proceed with a system this year or wait for the next cycle.

Texas does not mandate statewide net metering. Instead, homeowners rely on solar buyback programs, which credit excess solar energy sent back to the grid. While these programs differ by provider, they can significantly increase the value of a well-sized solar installation.

Leading buyback providers include:

Each provider uses its own structure—some offer one-for-one energy credits up to monthly usage, while others use variable rates or wholesale-based valuation.

For homeowners building toward optimal ROI, selecting the right buyback tariff can be just as important as choosing the right solar equipment. A well-aligned plan improves annual savings and ensures that excess production, especially in summer months, translates into tangible financial returns.

For businesses operating in Texas, solar delivers meaningful tax advantages beyond the residential landscape. The two most important incentives are MACRS accelerated depreciation and Bonus Depreciation, which together create substantial upfront tax savings.

Under MACRS, companies can depreciate their solar investment over an accelerated five-year schedule. With Bonus Depreciation still available, a large share of the system cost can often be deducted in the first year. This combination strengthens cash flow, shortens payback timelines, and enhances long-term ROI—making solar a strategic asset for farms, workshops, warehouses, restaurants, and other commercial facilities across Texas.

In many cases, businesses can reclaim 50–60% of their investment through federal tax mechanisms alone, before even factoring in energy savings or local rebate opportunities.

The combined effect of solar incentives texas offers is most visible when analyzing payback periods. Texas homeowners benefit from three structural advantages:

These components create a strong economic framework, often reducing payback times to 7–10 years, depending on system size, roof orientation, and local electricity rates. Homeowners using DIY Solar Kits can further optimize their investment by lowering installation expenses, speeding up the breakeven point, and increasing the transparency of the entire project lifecycle.

While incentive programs in Texas are relatively accessible, they do require accurate documentation and compliance with program rules. Key eligibility factors include:

Ensuring a clean document trail not only speeds up approvals but also minimizes delays when filing federal tax incentives or applying for utility rebates. For DIY customers, it’s important to confirm that all installation steps meet utility and code compliance to remain fully eligible.

Securing the available solar incentives texas provides is straightforward when homeowners follow a structured process. The most effective workflow includes:

A proactive approach ensures all incentives are captured and eliminates the risk of missing time-sensitive rebate windows.

Even in a favorable market, homeowners can lose out on incentives due to avoidable mistakes. The most common issues include:

By addressing these points early, homeowners can ensure predictable project economics and maximize the financial benefit of their solar investment.

Texas remains one of the most attractive solar markets in the country, even without a statewide solar tax credit. The strategic combination of the Federal ITC, the property tax exemption, strong local utility rebates, and competitive buyback programs delivers compelling long-term value for homeowners.

For anyone considering solar this year, understanding the available solar incentives texas offers is the key to accelerating ROI and securing the strongest financial outcome.

Homeowners exploring a cost-efficient path can also leverage AceFlex’s DIY Solar Kits to reduce installation expenses and maximize eligibility for federal benefits.

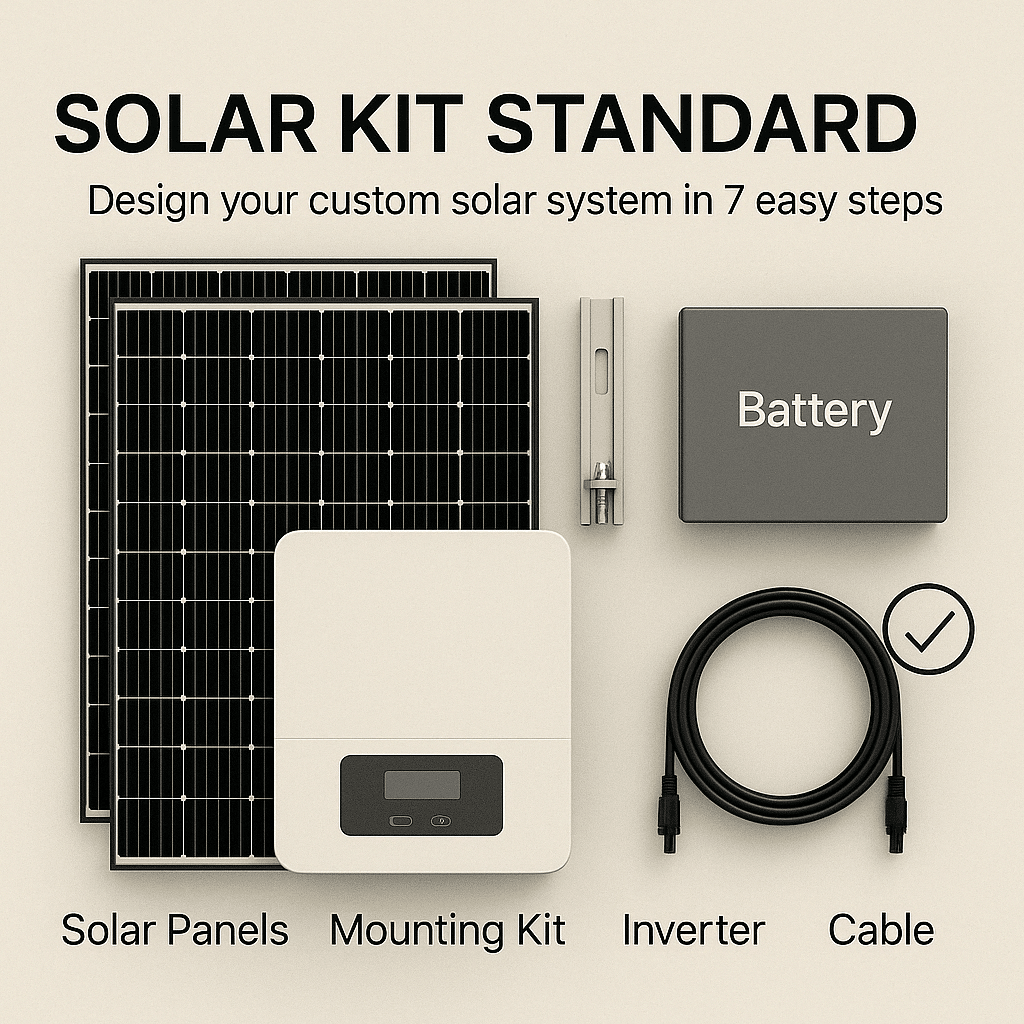

🔆 Standard Solar Kit – Your Custom Solar System in 7 Guided Steps

Design your solar setup with full flexibility and pre-configured mounting: choose solar panels, inverter, battery, mounting kit, wiring essentials, combiner, and accessories – all step by step and fully compatible.

✅ Includes mounting material from K2 Systems for standard layouts

✅ Choose only the components you need

✅ DIY-friendly and pre-checked for compatibility

✅ 🎁 Battery discount included when bundled

Yes. The 30% Federal Investment Tax Credit remains active through 2032, and utilities like Austin Energy and CPS Energy continue offering rebate programs as long as annual funding is available.

Yes. Utility rebates reduce the upfront system cost, and the Federal ITC applies to the remaining balance. This combination delivers a strong financial advantage and can significantly shorten payback periods.

Yes. Standalone batteries now qualify for the 30% Federal ITC as long as they meet the minimum capacity requirements. This makes energy storage far more affordable for Texas homeowners.

DIY solar systems still qualify for the Federal ITC. However, some local utility rebate programs require installations to be completed by licensed contractors, so requirements vary by territory.

Solar systems generally transfer to the new property owner. Thanks to the Texas property tax exemption, the added home value from your solar system remains exempt from increased taxation.

Texas does not offer a statewide solar tax credit, but homeowners benefit from the Federal ITC, the 100% renewable energy property tax exemption, and strong local utility rebates. Together, these programs deliver highly competitive financial outcomes.

There is no official 40% federal solar credit. However, homeowners can reach an effective savings level above 30% by combining the Federal ITC with local utility rebates, which reduce the project cost before calculating the tax credit.

Most 2,000 sq ft homes in Texas require a 6–10 kW system. Typical installed pricing ranges from $15,000 to $28,000 before incentives, depending on energy usage and system design. DIY Solar Kits can further reduce overall costs while remaining eligible for federal incentives.

Disqualifiers include leasing a solar system instead of purchasing it, lacking sufficient tax liability to claim the credit, attempting to apply the ITC to ineligible rental properties, or failing to retain proper documentation for IRS requirements.

Most removals are related to roof replacements, property sales, outdated lease contracts, or older systems reaching end of life. Modern solar systems are durable, require minimal maintenance, and deliver long-term economic value when properly sized.

AceFlex is one of the leading online retailers of renewable energy products and offers a wide range of solar products. We work with well-known manufacturers and wholesalers and can offer you cost-effective products in the field of photovoltaics so that you too can contribute to the energy transition.

Looking for an experienced team for planning your photovoltaic system without the hassle of doing it yourself? We are your trusted partner, offering comprehensive nationwide solutions. We provide expert consultation and supply of both photovoltaic systems and storage units tailored to your specific needs.

© 2026 Aceflex All Rights Reserved. Design by Media Pantheon, Inc.